The 9-Minute Rule for Estate Planning Attorney

Table of ContentsSome Of Estate Planning AttorneyHow Estate Planning Attorney can Save You Time, Stress, and Money.The Definitive Guide to Estate Planning AttorneyEstate Planning Attorney Fundamentals Explained

Your attorney will additionally help you make your records authorities, scheduling witnesses and notary public trademarks as essential, so you do not need to bother with attempting to do that last step on your very own - Estate Planning Attorney. Last, yet not the very least, there is valuable satisfaction in developing a connection with an estate planning attorney who can be there for you later onPut simply, estate preparation attorneys supply worth in many ways, much beyond simply providing you with published wills, trusts, or various other estate preparing documents. If you have concerns concerning the procedure and intend to discover more, call our office today.

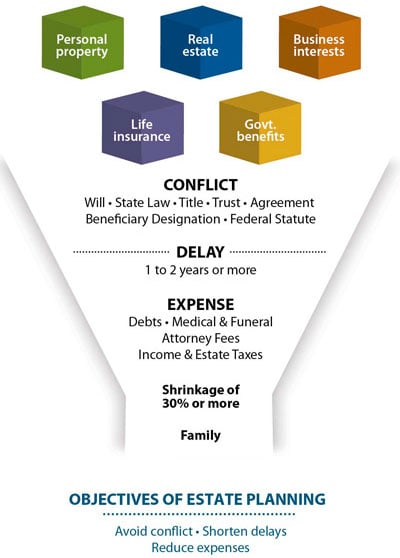

An estate preparation attorney aids you formalize end-of-life choices and legal papers. They can establish wills, develop trusts, develop healthcare instructions, establish power of lawyer, create sequence strategies, and much more, according to your dreams. Dealing with an estate preparation attorney to finish and supervise this legal documentation can help you in the adhering to eight areas: Estate intending attorneys are specialists in your state's trust, probate, and tax obligation regulations.

If you do not have a will, the state can decide exactly how to separate your assets amongst your successors, which might not be according to your desires. An estate planning lawyer can aid organize all your legal files and disperse your possessions as you want, possibly avoiding probate. Many individuals compose estate preparation records and afterwards ignore them.

The 9-Minute Rule for Estate Planning Attorney

When a customer dies, an estate plan would determine the dispersal of properties per the deceased's directions. Estate Planning Attorney. Without an estate plan, these choices may be delegated the near relative or the state. Responsibilities of estate organizers consist of: Developing a last will and testimony Setting up trust accounts Calling an administrator and power of lawyers Determining all beneficiaries Calling a guardian for small kids Paying all financial debts and reducing all tax obligations and legal fees Crafting instructions for passing your worths Establishing preferences for funeral plans Finalizing directions for care if you come to be sick and are unable to make choices Acquiring life insurance policy, disability revenue insurance coverage, and long-term treatment insurance A great estate strategy ought to be upgraded consistently as clients' economic situations, individual motivations, and government and state regulations all develop

Similar to any profession, there are features and skills that can aid you achieve these objectives as you function with your clients in an estate organizer role. An estate preparation career can be ideal for you if you have the complying with attributes: Being an estate planner indicates thinking in the long term.

5 Simple Techniques For Estate Planning Attorney

You need to aid your customer expect his or her end of life and what will happen postmortem, while at the very Continued same time not house on dark thoughts or emotions. Some customers might become bitter or anxious when pondering fatality and it could fall to you to aid them with it.

In the event of death, you might be expected to have various discussions and dealings with enduring household members concerning the estate strategy. In order to stand out as an estate planner, you might need to stroll a fine line of being a shoulder to lean on and the individual trusted to interact estate planning issues in a timely and specialist way.

tax obligation code changed countless times in the one decade in between 2001 and 2012. Expect that it this post has actually been modified even more considering that after that. Depending on your client's economic income bracket, which might advance towards end-of-life, you as an estate planner will certainly need to maintain your client's assets in complete legal compliance with any type of neighborhood, government, or international tax obligation laws.

Estate Planning Attorney Can Be Fun For Anyone

Acquiring this accreditation from organizations like the National Institute of Certified Estate Planners, Inc. can be a solid differentiator. Being this website a member of these specialist teams can validate your abilities, making you extra appealing in the eyes of a prospective client. In enhancement to the emotional reward of assisting customers with end-of-life planning, estate planners appreciate the advantages of a stable revenue.

Estate planning is an intelligent point to do regardless of your existing health and economic status. The very first important thing is to work with an estate planning lawyer to help you with it.

The percentage of individuals who don't understand exactly how to obtain a will has actually boosted from 4% to 7.6% since 2017. A skilled attorney understands what info to consist of in the will, including your recipients and special factors to consider. A will certainly safeguards your household from loss due to the fact that of immaturity or disqualification. It likewise gives the swiftest and most effective technique to move your properties to your beneficiaries.